Emerging markets (EM) are highly inefficient. Complicated governance structures, evolving macroeconomics and immature institutions

Emerging markets (EM) are highly inefficient. Complicated governance structures, evolving macroeconomics and immature institutions

Ashmore’s latest Market Commentary examines how EM debt and equities have behaved during past US easing cycles, and what the recent 25bps Fed cut could mean for investors.

A seismic shift is underway in global capital markets. The extreme concentration in US assets, a phenomenon driven by fiscal policies that ballooned the $US

As Artificial Intelligence evolves, it has the potential to be transformational for Emerging Markets (EM) through the advancement of economic development, by disrupting industries and,

Emerging Markets present an enticing proposition for global asset allocators, boasting a blend of growth potential and diversification advantages. EM specialist Ashmore Investment Management examines

The complexities exhibited by Emerging Markets create significant market inefficiencies and strong potential for meaningful alpha generation. Emering Markets specialist Ashmore Investment Management, a PAN-Tribal

The role of the human psychological cycle in driving stock and bond prices is well understood and pre-dates behavioural economics. There are elements that suggest we

Vietnam is often regarded as a ‘poster child’ for developing nations, offering a wealth of investment potential. This is with good reason, given several structural

The semiconductor industry stands out to Emerging Market specialist Ashmore as a research priority due to the idiosyncratic nature of its many cycle drivers, as

The past five years in Emerging Markets (EM) have been challenging, impacted by a series of global macroeconomic shocks that triggered elevated market volatility and

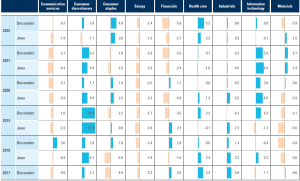

In 2022, Emerging Markets (EM) equities sold off on heightened risk aversion associated with geopolitical risk, reactive Fed monetary tightening and the strict Zero Covid

At a recent lunch presentation, Ashmore portfolio manager Edward Evans talked about the exciting investment opportunities available in Emerging Markets for the astute, disciplined investor.