Emerging markets – a positive long term outlook

At a recent lunch presentation, Ashmore portfolio manager Edward Evans talked about the exciting investment opportunities available in Emerging Markets for the astute, disciplined investor.

Emerging markets (EM) have changed over the years. Where once EM represented just one percent of the MSCI All Countries World Index, it now represents 12 percent. Where the investment universe spanned just 10 countries, it now encompasses more than 27.

As EM countries, their economies, policies and market structures, continue to develop and reform, this garners increased confidence among investors and buoys returns. In turn, this drives market liberalisation and improves market depth, or liquidity, which drives more investment. Consequently, the EM ‘story’ is at its core ‘self-fulfilling’. This does not happen in a straight line, which is why active management is essential for emerging market equities, both in terms of risk mitigation as well as driving attractive returns.

What does Ashmore look for?

- High quality – finding companies with something special, a network effect or ecosystem to sustain the competitive advantage, a sustainable runway of growth and competitive advantage. The company must also balance sheet strength to be resilient during tough domestic times and be able to re-emerge stronger than their weaker peers. ESG assessment is a key part of identifying quality as it steers the team towards high quality management teams that are aware of all their significant business risks and opportunities.

- Sustainable growth – while most EM managers focus on fast growth, Ashmore focuses on a balance of:

- Rapid growers – companies with strong innovation and secular growth prospects

- Mid-growers – companies with dominant industry positions and high visibility of sustainable growth

- Cyclical growers – those companies that are high quality yet operate in cyclical industries; have lower long term visibility and strong near term growth prospects

By investing in companies with different growth profiles, the risk/reward opportunities are better diversified and sustain alpha generation. This also means Ashmore is not beholden to a favourable growth environment to deliver positive returns for investors as has been proven during the Covid period.

- Attractive valuation – investors must have a strong valuation discipline to be successful in EM. Prices do not reflect fundamentals. This is especially true for the strong future profitability of mid or smaller size companies that are poorly researched. This means the team approaches the universe from an ‘all cap’ mindset. Moreover, risk often gets priced more quickly in perceived risk assets such as EM. Eventually, the mispricing is recognised, and assets are revalued. Active management enables Ashmore to systematically take advantage of such opportunities.

Case study: The semiconductor supply chain

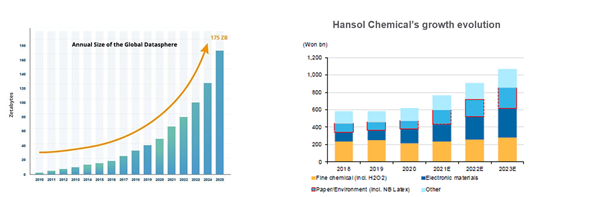

Ashmore seeks to identify business excellence and the most profitable part of a value chain. A great example is the ubiquitous semiconductor, which is employed in the manufacture of various kinds of electronic devices, including mobile phones, electric vehicles and battery technology. Described as the ‘new oil’, semiconductors have strategic geopolitical importance and a multi-year growth trend.

Hansol Chemicals

Hansol is a dominant supplier of chemical products and electronic materials used in semiconductors, OLED displays and EV batteries to a global client base, including Samsung. It has strong growth prospects across a range of high margin products, enabling a sustained improvement in margins and free cash flow generation.

Hansol is a dominant supplier of chemical products and electronic materials used in semiconductors, OLED displays and EV batteries to a global client base, including Samsung. It has strong growth prospects across a range of high margin products, enabling a sustained improvement in margins and free cash flow generation.

Hansol’s origins are rooted in the development of chemicals used in paper manufacturing. From there it moved to producing chemicals used in televisions and, more recently, into chemicals used in the manufacture of semiconductors and electric vehicles. Hansol provides a good example of a high quality management team able to use their specialisation to position the business to become a dominant player in providing specialty gas to a growing market segment.

Hansol has a very specific, highly profitable role in the huge value chain of semiconductors. Because it has such a significant market share, Hansol is now the ‘go to’ business. Its market dominance is a result of its demonstrated ability to meet regulatory requirements and not cause issues in the supply chain. This cements Hansol’s position as the provider of choice and means it is less likely to be replaced, even by a cheaper vendor, because the risk in doing so is too great.

If you’d like to know more about the Ashmore Emerging Markets Equity Fund please contact your Key Account Manager:

Mark Aufderheide (NSW)

E: mark.aufderheide@pantribal.com.au

M: 0408 847 211

Nick Baring (VIC/TAS)

E: nick.baring@pantribal.com.au

M: 0457 520 297

Dane Cuthbert (NSW/ACT)

E: dane.cuthbert@pantribal.com.au

M: 0448 534 418

Matthew Mantle (QLD)

E: matthew.mantle@pantribal com.au

M: 0408 451 549

David Myers (VIC/SA/WA)

E: david.myers@pantribal com.au

M: 0413 051 376