Ashmore Emerging Markets Equity Fund 5 year anniversary

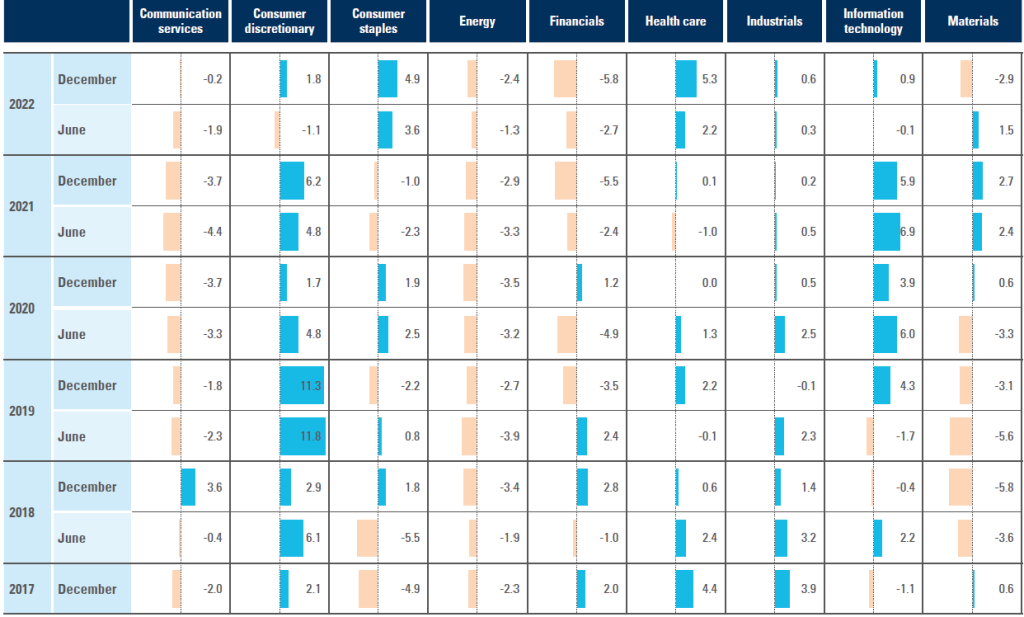

The past five years in Emerging Markets (EM) have been challenging, impacted by a series of global macroeconomic shocks that triggered elevated market volatility and gyrations in market leadership.

This was exemplified by the MSCI EM returning close to 0%, albeit including an over 90% positive move as well as witnessing its most protracted drawdown in history.

Ashmore’s EM Equity strategy successfully navigated this backdrop, demonstrating the rigour of its approach that identifies companies with structural competitive advantages that can sustainably compound their earnings.

The systematic nature of Ashmore’s process enabled the team to exploit market volatility to its advantage; while the well-diversified portfolio, complemented by an overlay of macroeconomic and quantitative tools, saw the Fund perform in a disciplined and consistent manner. The outcome was significant and sustained alpha generation reflected in top decile peer performance.

To read Ashmore’s review of the past five years, click here.